Anyone who took out a Spanish home mortgage in the last 20 years could be eligible to claim.

In Spain, thousands of homeowners overpaid on their expenses when they took out their mortgage.

In 2019, the EU Court of Justice issued a ruling which established that financial institutions should reimburse any customers who were charged expenses during the course of taking out their home mortgage.

The Spanish Supreme Court adopted the ruling established by the EU court and it is now possible to claim the following expenses:

- 50% of the Notary fees

- 100% of the Property Registry fees

- 100% Valuation fees

- 100% Arrangement fees (Gestoría)

Legal interest will also be applied to the amounts owed, which will be calculated from the date they were first paid when the mortgage was arranged until the date of repayment from the lender of the mortgage.

Start Now

Please Wait

CONTACT US TO SEE IF YOU ARE ELIGIBLE TO CLAIM

Mortgage Expenses Claim Q + A

What is a mortgage expenses claim?

A mortgage expenses claim is a reclamation of money from your bank in the situation that you were forced to pay associated expenses when you took out your mortgage.

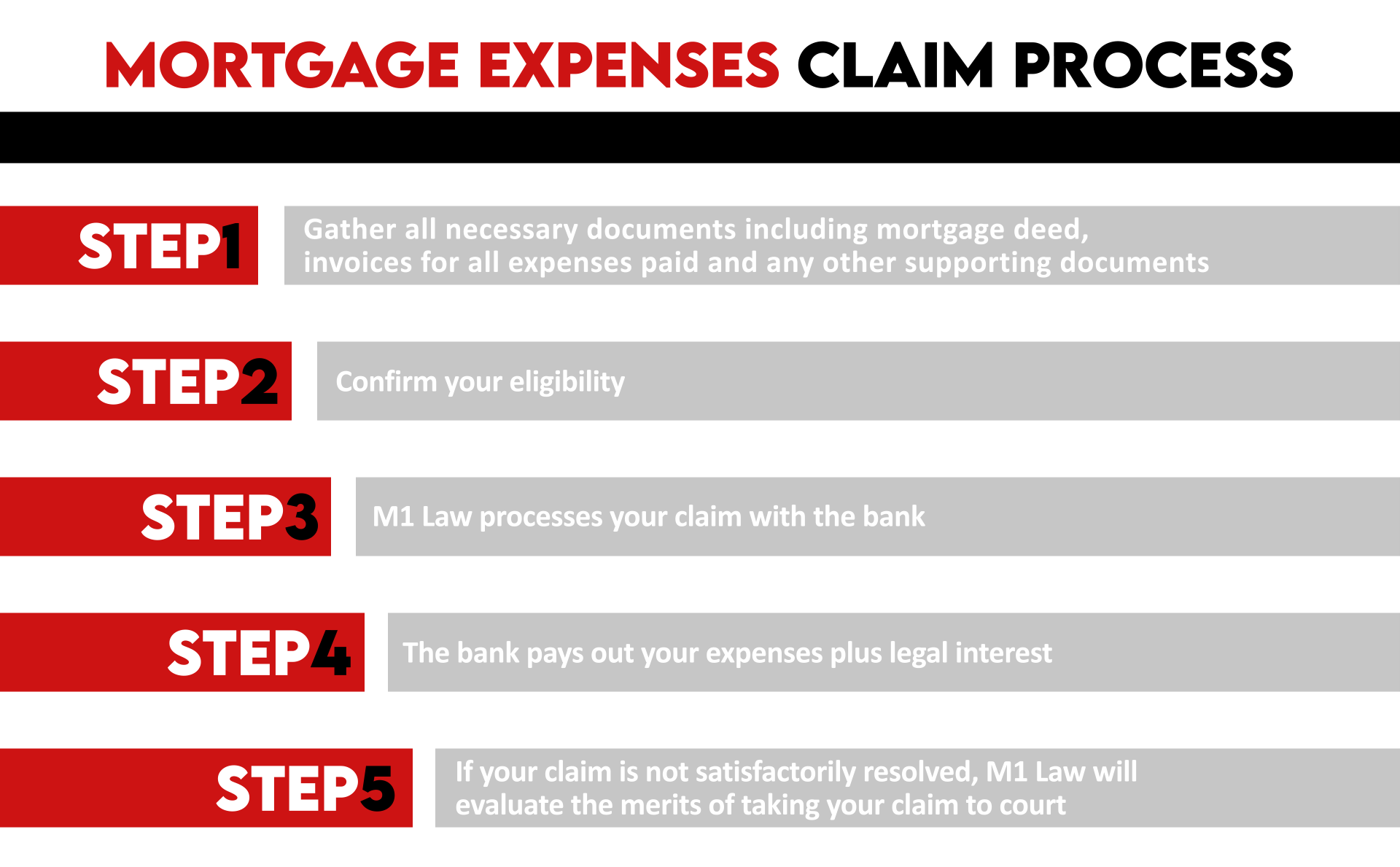

What do you need to claim?

The original mortgage deed

Invoices for all expenses paid

Can I claim if I took my mortgage out before 2019?

Yes! The law makes it obligatory for banks to repay customers who were forced to pay fees which came under the bank’s responsibility. As long as you can provide the necessary documents, there’s nothing stopping you from claiming.

Can I claim if I took my mortgage out after 2019?

Despite the adoption of the real estate law, some banks have continued to charge borrowers for expenses that are their obligation to pay. If you purchased after 2019 and were charged for expenses when taking out your mortgage, then you are entitled to claim this money back.

How long does a claim take to process?

From the time we receive your documents until settlement of your claim takes around 6 months unless further court action is required. However, most claims are settled within this timeframe.

How do I start?

If you would like advice to see if you have a solid mortgage claim, get in touch with M1 Law using the short contact form, or by calling our Spanish office on +34 951 41 95 81.

The M1 Law Legal Team

David Moriel

COLLABORATING LAWYER

LBA (Málaga, Spain) No. 10.309

Victor Serrano, Ph.D.

COLLABORATING LAWYER

LBA (Málaga, Spain) No. 5519

Tamara Gümmer

COLLABORATING LAWYER

LBA (Málaga, Spain) No. 10531

Laura Luna

COLLABORATING LAWYER

LBA (Madrid, Spain) No. 90992